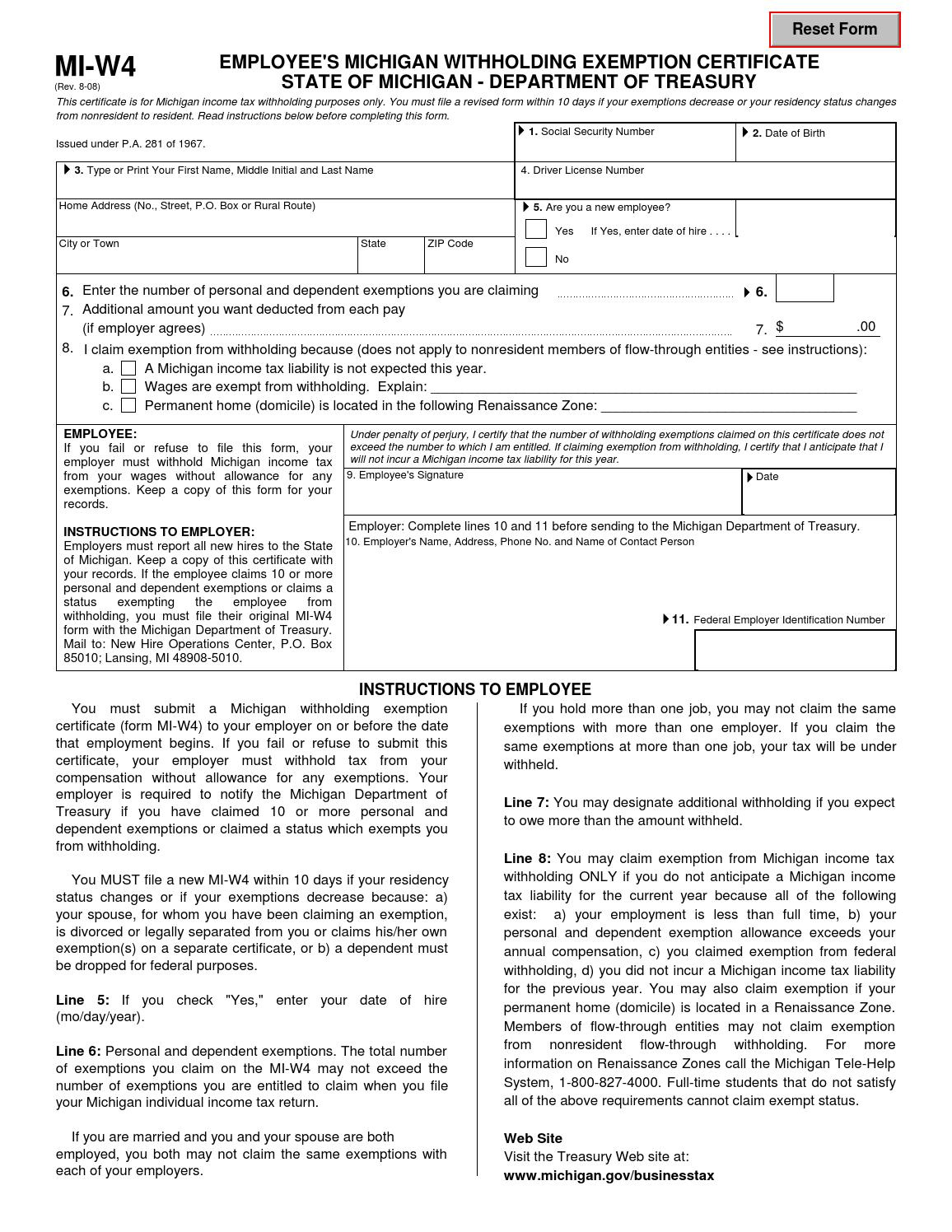

An employee completes a new form only when they want to revise their withholding information. In general, an employee only needs to complete Form NJ-W4 once. Employees may also use this form to request that an additional amount be deducted from each pay.

In cases like these, an employee should use the wage chart on the form to determine the rate to use when calculating State withholding amounts when filing Form NJ-W4. When an employee has more than one job, or if spouses/civil union partners are both wage earners, the combined incomes may be taxed at a higher rate. Your W-4 can either increase or decrease your take home pay.

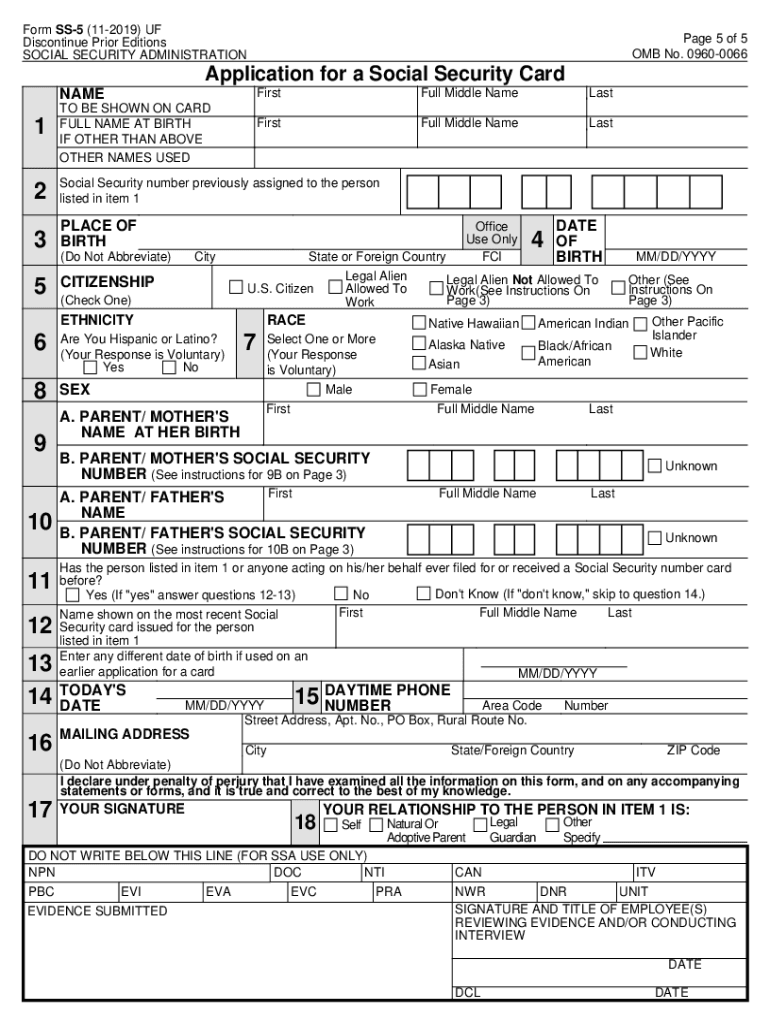

Withholding tax (also known as payroll withholding) is essentially income tax that is withheld from employees’ wages and sent directly to the IRS by an employer. New Jersey employers must furnish Form NJ-W4 to their employees and withhold New Jersey Income Tax at the rate selected. IRS Form W-4 is completed and submitted to your employer, so they know how much tax to withhold from your pay. The Form W-4 is a form that tells an employer the proper amount to withhold from an employee’s paycheck for federal income tax. Employee’s Withholding Allowance Certificate (Form NJ-W4)Įmployee’s Withholding Allowance Certificate (Form NJ-W4)Įmployees should complete an Employee’s Withholding Allowance Certificate ( Form NJ-W4) and give it to their employer to declare withholding information for New Jersey purposes.

0 kommentar(er)

0 kommentar(er)